According to Sub-Clauses 1.1.35 and 11.1.3 Green Book as integrated in the Contract Data, 2nd Edition, the Contractor shall be entitled to Prolongation Cost as follows, depending on the value of the Works (referred to as “V”), as certified under Sub-Clause 8.4.1, carried out at the time when the event (whether a Variation under Clause 7 or a claim under Clause 13) giving rise to an EOT claim occurs.

According to FIDIC -as expressed in the Guidance for the Preparation of Particular Conditions- Prolongation Costs are classified as indirect Costs suffered by the Contractor in case of a critical delay, and they cover on-Site and off-Site overheads in accordance with the definition given in Sub-Clause 1.1.35 as set out in the Contract Data.

In terms of the concept concerning compensable prolongation costs, FIDIC expressly relies in the Guidance Notes on the “authoritative industry guidance such as the “Society of Construction Law Delay and Disruption Protocol”, 2nd Edition, 2017, available for download at https://www.scl.org.uk/sites/default/files/documents/SCL_Delay_Protocol_2nd_Edition_Final.pdf”.

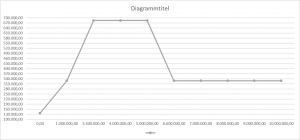

If V = 0, PGC = 25% of W per day of EOT

If V > 0 and V < 33% of the Contract Price stated in the Contract Agreement, PGC = 60% of W per day of EOT

If V >= 33% and V < 66% of the Contract Price stated in the Contract Agreement, PGC = 125% of W per day of EOT

If V >= 66% of the Contract Price stated in the Contract Agreement, PGC = 60% of W per day of EOT

Where W is the average Weight (W) of the on-Site and off-Site overheads per day, and W= 20% of the Contract Price stated in the Contract Agreement, divided by the Time for Completion for the Works stated below.

Vide Sub-Clause 11.1.3 FIDIC has introduced a new concept into FIDIC contracts, Prolongation Cost. The Guidance Notes reveal that Prolongation Cost or PGC can be claimed in the case of cost flowing from a compensable delay, but not from an excusable delay, as stipulated under the opening provisions of Sub-Clause 11.1.3.

FIDIC elaborates that an excusable delay is one giving rise to an entitlement to EOT only. This is typically a delay resulting from a natural event, such as a natural Exceptional Event (natural catastrophes such as earthquake, hurricane, etc.) under sub-paragraph (c), Unforeseeable adverse climatic conditions at Site under sub-paragraph (f), etc. A critical delay resulting from those risk events will, therefore as decided by FIDIC, only be excused, but not compensable. While the Contractor shall be discharged from the application of any delay damages for that particular delay, but it shall not be entitled to claim prolongation costs resulting from such delay. The financial risk resulting from such risk, will be an exclusive Contractor´s risk.

The formula as laid down in the Contract Data and as explained in the Guidance Notes and as interpreted by the author reads as follows:

The formula results in the following entitlements based on the assumption that the Contract Price is equal to 10 Mio USD.

According to Sub-Clause 1.1.35 as amended by the Contract Data Prolongation Costs shall be the only compensation for EOT resulting from a compensable delay. FIDIC advises users in the Guidance Notes on their view that the above wording suggests a liquidated damages provision.[1] As observed by Lord Dunedin in the English case Dunlop, “though the parties to a contract who use the words ‘penalty’ or ‘liquidated damages’ may prima facie be supposed to mean what they say, yet the expression used is not conclusive”.[2] The question whether a damages clause is a penalty falls to be decided as a matter of construction, therefore as at the time that it is agreed.[3] Under English law a clause or provision will constitute a penalty clause [4]

- If the sum provided for does not correspond with a genuine pre-estimate of damages,[5] though the provision will not be treated as penal solely because it is impossible to estimate in advance the true loss likely to be suffered.

- if the sum provided for is „extravagant and unconscionable“ in comparison to the greatest loss that could conceivably be shown to result from the breach.

- if the breach consists solely of the non-payment of money and it stipulates a larger sum.

- if the same sum is payable for a number of breaches of varying degrees of seriousness.

By contrast Section 74 of the Indian 1872 Contracts Act makes no distinction between liquidated damages and penalties, and allows for contractual damages for failure to perform even if the intention is to penalize. Also, civil code jurisdictions usually do not distinguish between liquidated damages clauses and penalty clauses in order to test the enforceability of any of them.

While the FIDIC comment does not provide conclusive evidence for the meaning of contract wording, courts and arbitrators may construe standard forms in the light of existing Guidance Notes.[6] The new formula approach is manifestly inconsistent with the above English test criteria, in that it does not correspond with a genuine pre-estimate of damages and Prolongation Costs shall become due for a number of events of varying degrees of seriousness. On the other hand, the FIDIC wording and the formula in itself demonstrate clearly its compensatory objective. Accordingly, it will be extremely difficult to challenge the enforceability of Sub-Clause 1.1.35 Green Book as laid down in the Contract Data.

Another challenge to the wording and the concept arises from the tendency of civil law legal jurisdictions to reduce contractual penalties perceived as excessive. Many, but certainly not all, civil codes seem to have adopted the rule to give authority to the courts to reduce an excessive penalty (e.g. Art. 1136 et seq. French Civil Code, Sect. 343 German Civil Code, Art. 114 of the Chinese Contract Law, Art. 1309 Indonesian Civil Code, see also the 8% cap under Article 307.2 of the Vietnamese Commercial Law).

In any case the innovative new approach will be welcomed in that it will certainly help to reduce discussions on causation and substantiation for Prolongation Costs. Less extensive debate between the Parties as to what is and what is not an eligible expenditure under such a heading is desirable. The reduced likelihood of this resulting in a dispute is significant. In arbitration, parties will frequently rely on expert evidence in order to demonstrate their prolongations costs claims, through the mobilisation of so-called quantum expert witnesses. Though this is rather questionable in the light of Sub-Clause 13.1 (duty to submit contemporary records) and Sub-Clause 13.2.2 [failure to comply with any Sub-Clause of the Conditions of Contract], it is still likely to happen.

[1] See Guidance Notes, Commentary on Sub-Clause 11.1.3 “Prolongation Costs”

[2] Dunlop Pneumatic Tyre Co Ltd v. New Garage and Motor Co Ltd [1915] AC 79

[3] Cavendish Square Holding BV v. Talal El Makdessi (Rev 3) [2015] UKSC 67 (4 November 2015) referring to: Public Works Comr v. Hills [1906] AC 368, 376; Webster v Bosanquet [1912] AC 394; Dunlop Pneumatic Tyre Co Ltd v New Garage and Motor Co Ltd [1915] AC 79, at pp 86-87 (Lord Dunedin); and Cooden Engineering Co Ltd v Stanford [1953] 1 QB 86, 94 (Somervell LJ)

[4] See the detailed legal analysis in Cavendish Square Holding BV v. Talal El Makdessi (Rev 3) [2015] UKSC 67 (4 November 2015)

[5] See Clydebank Engineering and Shipbuilding Co v. Don Jose Ramos Yzquierdo y Castaneda [1905] AC 6

[6] See Matthew Hall Ortech Ltd. v. Tarmac Roadstone Ltd. (1997) 87 BLR 96

Oldenburgallee 61

14052 Berlin

Tel.: 00 49 (0) 30 3000 760-0

Fax: 00 49 (0) 30 51303819

e-mail: ed.ke1770531960oh-rd1770531960@ielz1770531960nak1770531960

https://www.dr-hoek.com